Category: Collections

BNPL Collection Services: How a Collection Agency Helps Buy Now Pay Later Providers Recover More

BNPL Collection Services: How a Collection Agency Like IC System Supports Buy Now Pay Later Providers Buy Now, Pay Later (BNPL) programs are transforming consumer purchasing behavior across retail, e-commerce, and service industries — and financial service providers are taking notice. As BNPL adoption grows, so does the need for a trusted collection agency offering

IC System Named a 2025 Star Tribune Top 200 Workplace!

A Bold Vision from Day One When I joined IC System in the spring of 2017, I was handed a copy of the company’s strategic plan. As I read through it, one goal caught my eye: “Best place to work designation.” I remember thinking, how cool is that? A company bold enough to put

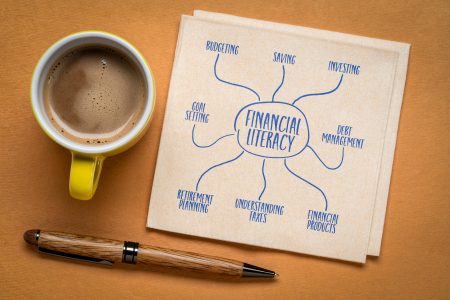

Collections & Financial Literacy: A Clear Connection

Financial literacy is a cornerstone of long-term financial health, yet many consumers struggle to fully understand their personal finances. In recognition of Financial Literacy Awareness Month this April, it’s important to highlight how even a collection agency can play a valuable role in supporting financial education. By helping consumers gain a clearer understanding of budgeting,

Reflecting on a Year of Giving: IC System’s 2024 Community Involvement

At IC System, giving back is more than a tradition—it’s part of who we are. As we look back on 2024, we’re proud to share In the Community, our annual review of IC System’s presence and activity in our communities. From donation drives and fundraising events to volunteer efforts and sponsorships, this past year reflects

Celebrating Women’s History Month: Honoring Ruth Johnson Erickson’s Legacy at IC System

Recognizing a Trailblazing Leader This Women’s History Month, we recognize and celebrate the extraordinary achievements of Ruth Johnson Erickson, a trailblazer for women in leadership and a pivotal figure in the history of IC System. Ruth’s leadership not only shaped the trajectory of IC System but also inspired generations of women to break barriers in

Customer Retention During Collections: Tips for Maintaining Trust and Loyalty

The debt collection process can be delicate, but with the right approach, businesses can retain customers while still recovering overdue payments. Here are some actionable tips to maintain trust and loyalty during collections: 1. Communicate Transparently Open and honest communication is critical. Ensure your customers understand their debt, payment options, and any consequences for non-payment.

Maximizing Debt Collection During Tax Season: Strategies and Insights

Maximizing Debt Collection During Tax Season: Strategies and Insights Tax season presents a golden opportunity for businesses to recover unpaid debts. As many consumers receive tax refunds between January and May, this influx of cash makes it an ideal time to reach out to slow-paying or non-paying individuals. Here’s how you can capitalize on this

Top FAQs About Hiring Collection Agencies: What Every Business Owner Should Know

Top FAQs About Hiring Collection Agencies: What Every Business Owner Should Know For business owners, hiring a collection agency can raise questions about costs, processes, and outcomes. Understanding these FAQs can ease concerns and help you make the best decision for your company’s needs. Here are some common questions about working with collection agencies: 1. How

Collection Agency vs. Small Claims Court: Making the Right Choice for Your Business

Collection Agency vs. Small Claims Court: Making the Right Choice for Your Business When businesses encounter unpaid debts, the choice between hiring a collection agency or going to small claims court is crucial. Both options have unique advantages, and carefully considering factors like cost, time, and potential outcomes will help determine the right path for

The Art of Customer Payment Recovery

How to Collect Debt Without Damaging Important Relationships When you’ve been helping businesses with customer payment recovery for decades, you learn what works—and what damages trust. At IC System, we know that collecting a debt from a customer does not have to harm the relationship. With clear communication, ethical practices, and genuine empathy, you can