Category: Collections

How Debt Collection Works: Client Success

Business relationships last because of excellent service. No matter your industry, the level of service you receive will often shape whether you value the ongoing relationship. When you partner with a collection agency and have questions about their service, someone knowledgeable should be available to provide a friendly experience. You should also have access to

When Does Your Small Business Need Debt Collection Services?

How much time do you spend calling or sending letters to your past-due consumers? Chances are, it’s too much time. Or maybe it’s not enough. One of the main reasons that many small businesses fail is because of poor business planning. An effective business plan should include a detailed accounting of your cash flow and

How Debt Collection Works: Collection Strategy

Written correspondence and calls are the bread and butter of a debt collection strategy. IC System’s “How Debt Collection Works” blog series continues with a discussion of our proven correspondence and call approach. Mike Selbitschka, IC System’s Vice President of Operations, talks about the collection strategy and efforts that occur after you have selected your

How Debt Collection Works: Data Scrubbing

Data scrubbing to ensure accurate consumer information is an essential debt collection tool. IC System’s data scrubbing and optimization program cleans your accounts to support effective collection efforts with higher quality data. Having good data means we take a smarter approach to your accounts. IC System’s “How Debt Collection Works” blog series continues with this

How Debt Collection Works: Account Placement

Not all accounts are ideal for collection efforts. It’s difficult to know which accounts you should send to your collection agency and when. IC System’s “How Debt Collection Works” blog series continues with a discussion about the best practices for account placement. You have already received some tips for choosing a collection agency and advice about which products

IC System’s COVID-19 Response

A message from IC System’s President & CEO, John Erickson: As we all adjust to these uncertain times, know that IC System is fully operational and ready to help generate revenue on your behalf. Managing your A/R may not currently be your first priority during this pandemic, but rest assured that we will continue to

Local Distillery Inspires with Their Coronavirus Response

As everyone continues to process the headlines and changing reality concerning the COVID-19 situation, it’s always nice when you find someone whose coronavirus response gives you inspiration and hope. That’s certainly the case with Vikre Distillery, a Minnesota spirits maker that normally creates a variety of gins, vodkas, and whiskeys. Faced with the pandemic and

Tax Deadlines Change in Response to COVID-19

As a response to the coronavirus pandemic, the U.S. Treasury Department has announced that individual taxpayers and businesses have a new deadline to file their federal returns and pay their taxes: July 15. It was announced on Friday, March 20, that the new July 15 deadline would be moved as another measure by the U.S.

How Debt Collection Works: Select Your Product

You’ve already received some advice about how to determine if IC System is right for your office. Now you need to select your product or collection service. To continue our blog series about how debt collection works at IC System, Tom Mayfield, a District Sales Manager with over ten years in debt collection sales experience,

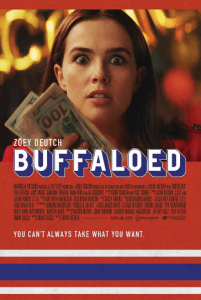

New Movie “Buffaloed” Takes Aim at Collection Industry

There’s a new movie called Buffaloed that sets its sights on the debt collection industry. It portrays debt collectors as shady criminals who are willing to knock on doors, make nasty threats, and dupe the elderly into repeatedly paying off the same debt—anything to collect on the “paper” they have purchased from creditors. The movie concentrates on